So some of you college folk are likely gearing up for midterms in the coming weeks which got us thinking. You sure do pay a lot of money for those midterms. And those professors. And those books. And those itty bitty college dorm rooms. Now, I don’t think there are many people on this planet that had a worse strategy for financing their college tuition than I did. This is why I feel I am an authority on the many mistakes that are made regarding that ever so sought after college degree.

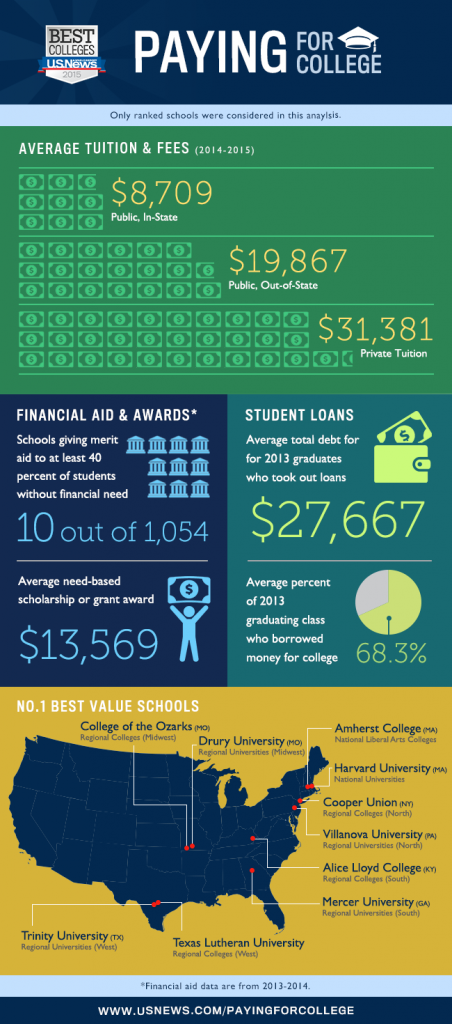

According to the College Board, the average cost of tuition and fees for the 2013–2014 school year was $30,094 at private colleges, $8,893 for state residents at public colleges, and $22,203 for out-of-state residents attending public universities.

Yikes. My father and the people of his generation often like to talk about how they financed their own educations and paid their way etc and so forth. They also talk about how they trudged through 4 feet of snow and ice bThe issue I take with that is the cost of college back in 1977 was $770 a semester give or take. Why has tuition gone up exponentially? It’s not just inflation believe me. Loans guaranteed by the government is much more so the answer. So what are some strategies to cope with this tremendous increase in cost?

1. The 529 Plan and the like. As soon as little Tommy is born, parents should think about a strategy to finance college. The 529 Plan is popular. Your money grows tax deferred to help him pay for school. You would be surprised how even the smallest contributions over time can grow to seriously help little Tommy out when it comes time to pay for school. The 529 Plan also has a slew of tax benefits associated with it for those of you who love big tax refunds or small tax balances. Parents really should have some kind of plan to contribute to and grow some money to allocate specifically to Tommy’s tuition. Even the littlest bit can help. If you have more questions on plans to pay for school, feel free to contact us.

2. Transferring. Now in some cases this scenario may not be as fruitful as it could have been in mine. If I had gone to a community college for my first two years, and then transferred to Fordham University to finish out my bachelors degree, the savings would have been tremendous. Around $40,000. And in the end, I would have gotten the same degree holding the same reputation and the same rate. Does this make things a bit more complicated in that you would have to go through a process of transferring from school to school? Maybe. But is this trouble worth $40,000? Definitely. Again, may not be for everybody but it is certainly an option to consider.

3. Don’t go. Hold your horses and don’t rip my head off just yet. I know I am going to catch tremendous flack for this one. Now, the statistics DO prove that people with college degrees are much better off financially and career wise and lifestyle wise. But college may not be for everyone. Maybe a trade school is more your style. Maybe buying a boat load of books on business and teaching yourself the skills you need to succeed in life. If you think about it, many of the worlds most powerful, successful and rich people are college dropouts. Now I am not saying you are the next Mark Zuckerberg. What I am saying is college seems to have become the assembly line process of life and I feel that some people are not destined for college. Did I go? Yes. Do I wish I didn’t? I won’t lie. Sometimes I question it. I did discover my passion in school (marketing). I love to help companies grow and the seed was certainly planted in college. But unfortunately there is a big problem in this country regarding student debt. Most of what I’m saying here is I don’t want you (the student), or you the parents to shell out $140,000 to have it not pay off in the end. College to me is an investment. Sometimes that investment can pay off in a big way and sometimes it can do a nose dive and crash and burn.

I will add that a lot of the stuff I am truly good at is self taught. I taught myself to play guitar. I taught myself the ways of digital marketing. Well I read dozens of books and hundred of articles. But I still consider that teaching myself. I did not teach myself Muay Thai or Brazilian Jiujitsu but spent countless hours by myself trying to get better at it and it was in that self teaching phase that I made tremendous stride and discoveries. So consider some of these tips when thinking about college tuition. Obviously, there are other ways to cope with the financial burdens of college which I have gone over more so here. Remember that most of this is just food for thought so don’t take it the wrong way. Check out the informative infographic below about the universities with the best bang for your buck.